by Robert Lynch; September 5, 2024

Back last April 30th at a Budget Retreat that Tompkins County legislators open to the public only because the law says they must, lawmakers directed County Administrator Lisa Holmes to craft a next year’s budget with a tax levy increase of no more than two percent. Holmes dutifully did so, instructing department heads afterward to cut their requests by five per cent to make the numbers work.

The Administrator prepared the requested budget. But for all intents and purposes, when she delivered her budget message to the County Legislature Tuesday night, she might as well have shut that two-percent budget into a drawer. Very little of it reached the Legislature’s floor that night.

What Holmes did detail—and what legislators took nearly an hour to digest and discuss—was a budget of a much different stripe. It would hike the levy increase by more than twice of that requested in April.

The Administration’s “Recommended Budget” would impose on property owners a 4.34 percent tax levy increase. And for the first time, its total would cross the quarter-Billion dollar threshold, spending $252,317,460, to be exact.

What drove the change was a late-August independent audit report that showed that while Tompkins County government remains rich, little room remains to tap existing governmental savings—the “fund balance”—to pay for the things property taxes would otherwise support.

“If we had started with the information that we gleaned in August, and we wanted to arrive at a two per cent (budget),” Holmes told the Legislature, “we would have needed to cut a lot further earlier on in the game, knowing that we did not have fund balance to budget. So that’s left us to the point that we’re at.”

At bottom, the choice is simple: Should government keep more of your money in its own piggy bank? Or should it allow you to retain more of that money in the bank of your choice?

The recommended levy increase falls just under the largely-symbolic 4.45 per cent “tax cap” New York State has calculated for Tompkins County this year. As neutered over the years, that cap holds little more than the persuasive power for frugality. As the County’s budget process progresses, it’s easy to see how legislators may spend beyond it.

“In my opinion, we’ve artificially kept the tax levy low the last few years at least by taking fund balance to not raise the tax levy, and I think due to numerous factors that are going on, we absolutely can’t do that, hopefully, anymore,” Ulysses-Enfield legislator Anne Koreman stated.

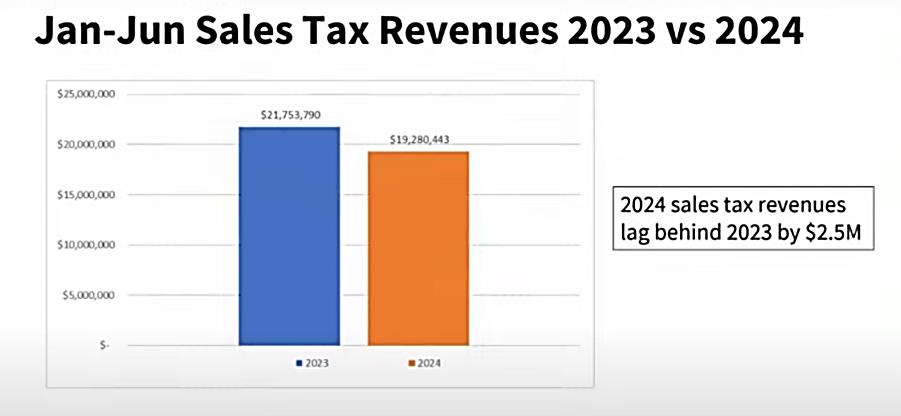

True, county sales tax receipts this year have proven more sluggish than expected. Expenses are creeping up. New York has offloaded new mandates to its counties. But what’s crippled the budget process the most is a new Fund Balance Policy, enacted by the County Legislature amid little attention last December.

The policy change—one which Koreman supported, but which Enfield’s other legislator, Randy Brown, opposed—now requires that a full 25 per cent of a prior year’s expenditures be kept in fund balance. In past budgets, only 18 per cent of prior revenues had to be retained. At the time, one legislator contrasted the difference between locking away $32 Million dollars and now $45.3 Million.

The August audit showed Tompkins County held nearly $61 Million in Unassigned Fund Balance at the end of 2023. But through a pair of actions also during the past year, the Legislature shunted about $12.6 Million of that total into reserve accounts, untouchable except for their intended purposes. What’s left is about $48 Million. And that’s just about the number that auditors say needs to be set aside under the new policy.

“This was the executive decision that I made,” Holmes said to defend her aiming the tax levy higher than the Legislature had directed. “And hence the Two Percent Budget is presented for your review, and the 4.34 Percent Budget is my recommendation.

In terms of total spending—a metric seldom given much attention these days—the Recommended 2025 Budget would cross the $250 Million mark, yet only raise outlays by about $4 Million, or 1.6 percent, from the current year’s budget that’s posted on the County’s website.

A multi-meeting, committee-of-the-whole budget review process begins almost immediately; its first session occurs Thursday, September fifth. All legislators attend those “Expanded Budget Committee” sessions. Department heads and the community activists in search of handouts troop to chambers and make their pitches. By the end of October, a final budget emerges. It’s usually larger than what the County Administrator had proposed. Lawmakers traditionally find it hard to say no.

Yet some predict this year may be different.

“It’s going to be a really, really hard budget season,” former Legislature Chair Shawna Black observed Tuesday.

“Traditionally, we have been very used to putting in ‘OTR’s’ (spending add-on’s) as legislators and having our hopes and dreams out there in the community. We’ve listened to the people who live here. We’ve listened to the non-profits, and we’ve been able to really invest in our community,” she added. “It’s not to say that we’re not going to do it this year, but I think we are going to have to tighten our purse strings a little bit and prioritize what’s really important to our community.”

But the gap between the Administrator’s 4.34 per cent levy hike and the 4.45 per cent tax cap leaves little room to grow spending within the cap’s confines.

In response to legislator Lee Shurtleff’s prodding, Holmes acknowledged that both of her draft budgets would be shared side-by-side during the course of upcoming deliberations. Yet, Budget Committee Chair Mike Lane made clear Tuesday that the lower-taxing alternative will assume second-class status.

“The Expanded Budget Committee will take up the Recommended Budget from the County Administrator,” Lane told Shurtleff after he’d asked for a starting point. “And she (Holmes) is recommending a 4.34 percent tax levy increase. She is not recommending the two percent one, although she’s prepared one at our request.”

With legislators perennially averse to cutbacks, one can easily infer from Lane’s words that the higher-tax budget is the only one that really matters, and that the two percent budget can best be disregarded.

What’s already emerged as the major point of advocacy this year is continued County funding for the “Community Justice Center” (CJC), a shared City of Ithaca/Tompkins County initiative that emerged from the 2021 Reimagining Public Safety collaborative. Loosely-defined, the CJC keeps a check on suspected police misdeeds, particularly in Ithaca. The Two Percent Budget may defund CJC. The Recommended Budget would not. Community advocates have already lined up in the CJC’s defense.

What the Recommended Budget also does, Holmes acknowledged, is to add back some—though not all—of those five per cent cuts she’d earlier asked department heads to make.

Legislator Greg Mezey quizzed Holmes as to what extent they’d come back. The Administrator did not give percentages. However, her PowerPoint that night stated that the higher budget “includes all restorations under the 2% increase/5% cut scenario.”

Arguably, it is the 25 percent Fund Balance Policy—perhaps that policy coupled by the newly-set reserves—that made this year’s budgeting a challenge. The policy was adopted last December by only a nine-to-five vote. It lacks universal acceptance. Nevertheless, no one has talked about repealing it.

Might there be another place to save? Newfield-Enfield’s Randy Brown eyed County Government’s higher-than-expected employee vacancy rate. Jobs found vacant don’t pay salary or benefits.

Brown estimated each vacancy saves $50,000. “If you’re down 89 employees now… we may refund some of the fund balances with that money,” Brown suggested.

Using Brown’s math, fund balance savings could exceed $4 Million. Holmes cautioned the calculation is risky as the vacancy rate fluctuates.

“But the money’s been gobbled up by negotiations for our various labor unions,” Mike Lane cautioned.

“For the most part, I have not funded new initiatives,” Holmes told legislators.

“I’m calling this a transition year,” the County Administrator explained. “You may be asking what are we transitioning to? My answer would be to a period where we’re going to need greater fiscal discipline in recognition of the economic climate and the very robust capital plan that we have before us.”

One of those capital initiatives is a $40-60 Million Center of Government, a building whose planning the Recommended Budget would advance. No one talked Tuesday of sidelining the office building for sake of economies.

Meanwhile, adherence to the Fund Balance Policy has proven slavish. Budget planners choose to bend to the policy, rather than to have the policy bend to them.

Holmes’ budget message also gave short shrift to economies; of simply doing without. Departments were asked to cut. Some did. Others apparently resisted. And those that balked were placated in the Recommended Budget. Same goes for capital projects.

“Like the operating budget,” Holmes said, “the projects in the Capital Plan encompass many of the needs, priorities and values put forth in our Strategic Operations Plan,” a document lawmakers recently accepted. The words that followed may provide some taxpayers scant comfort.

“The policies and reserves that have been established provide us with a roadmap for getting there,” Holmes said of reaching the strategic goals. “It’s also going to take additional and gradual growth in the tax levy to fund the many capital projects we have before us, because it can’t be assumed, given what we’re seeing with sales tax revenues and the number of projects that we have, that fund balance will be self-replenishing.”

As Shawna Black said, this budget season is going to be “really, really hard.” And one can pretty much assume, unless there’s a taxpayers’ revolt, that the Two Percent Budget is a horse that’s departed through the barn door. We have yet to learn how many property owners will run out to chase it.

###