Reporting and Analysis by Robert Lynch; April 30, 2025

A tornado warning came in from the National Weather Service better than halfway into the meeting. Somebody read it off her computer or phone. “Take cover now! Move to a basement or an interior room on the lowest floor of a sturdy building,” the message said. Attendees had convened in the Rice Conference Room at the Tompkins County Health Department.

“This is pretty good,” Tompkins County Administrator Korsah Akumfi said, evaluating his room’s presumed sturdiness. The meeting went on.

By best accounts, there was no tornado. But inside the Rice room that night, especially for Deputy County Administrator Norma Jayne, sitting nearest her boss, a different kind of whirlwind was swirling. For more than two hours, during a meeting that those in charge would generally prefer people like us not attend, Jayne found herself constantly plugging holes in Administration’s first look at a 2026 Tompkins County Budget.

Maybe it was best that no one from the downtown media bothered to attend the County Legislature’s little-publicized annual “Budget Retreat” April 29. It was a challenge for the best of minds to keep thoughts straight or grasp a coherent narrative. Other than the County Administrator’s daughter, this Enfield Councilperson was the only person in the room not on the County payroll. There’ll be no video replay. For many, perhaps, it was a meeting to forget.

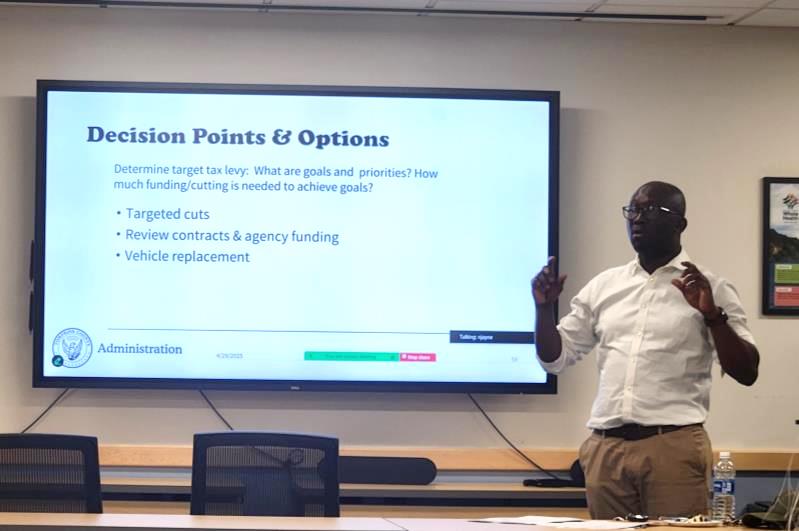

But it won’t get forgotten. News was made. Legislators left the session learning that if current programs and personnel are left intact, next year’s Tompkins County property tax levy could rise by 7.11 percent. And should the tax levy increase fall to that of the estimated 3.06 percent state-directed tax cap, administrators and lawmakers would need to make more than $2.2 Million in program and personnel cuts.

“What you’re telling me is we’re over budget at this point,” Lansing Republican legislator Mike Sigler replied to Administrator Akumfi and to the room, reaching for a conclusion that begged to be stated.

Still, don’t be scared away by the ominous prospect of a seven percent tax increase. It’ll likely never happen.

For one thing, it’s a legislative election year. And for another, April warnings of a higher-than-desirable tax increase invariably vanish by October, budget adoption time. Steep increases generally get whittled away, even if it takes dipping into savings to make that happen. This year may prove no different.

“Neither of the choices are the one I would pick,” Legislature Chair Dan Klein said Tuesday of Akumfi’s two alternatives, either the one carrying the higher tax increase or the one with the $2.2 Million in cuts. Klein declined to state where he’d draw the line.

The “Budget Retreat” has become an understated, yearly ritual. State law demands it be open to the public. But it’s not an official meeting where actions become binding and minutes are kept. Legislators meet away from their downtown chambers ostensibly to keep their first look at next-year budget projections as informal as possible. Their spiriting away also encourages comments be held as private as the law allows. Few outsiders—or reporters— ever venture out to hear what’s spoken.

At the retreat one year ago, former County Administrator Lisa Holmes had advanced a “Maintenance of Effort” budget that would have carried a 5.9 percent tax levy increase. Legislators that night balked, casting a series of straw votes that messaged to Holmes a levy increase of no more than two percent. Keeping it that low would also have required more than $2 Million in cuts to programs.

Holmes couldn’t stick to the directive, although she tried. In November, following a summer full of number crunching and department head pushback, legislators settled on a 2.72 per cent levy increase for 2025, exactly equal to the then-calculated tax cap. Tompkins County’s tax levy increase had been two percent for the prior year; no increase at all for each of the two years before that.

At Tuesday’s most recent budget retreat, there were no straw polls, no haggling, no target tax increases set. Newly-hired Administrator Akumfi discouraged legislators from early-on goal-setting. Akumfi would do things differently.

“When you meet with the departments, ask ‘Why do you need this extra item?” Akumfi advised legislators. “You need to justify why the increase is so high,” he’d tell department heads.

It’s actually the County Administrator who first negotiates with heads of departments. Legislators, themselves, don’t meet with them until autumn.

In essence, the new Administrator has appeared to signal a preference for bottom-up, rather than top-down budgeting. By his message, Akumfi would first urge departmental austerity, next bundle up whatever fell into his spending basket, and then calculate taxpayer burdens based on what’s within it.

Tompkins County Government has never done budgeting that way in modern times. But that’s how Akumfi might want it. And the approach seemed to throw some legislators a bit off balance.

“Will there be an ‘action item’ when you can come to us and ask us for a comfort level?” the Legislature’s Budget Committee Chair, Mike Lane, a long-tenured legislator, asked Akumfi.

Lacking a response he found sufficiently convincing, Lane requested, and then secured, permission for a second budget retreat sometime this summer, likely in July.

Tompkins County’s procedures require the Administration Department to present a draft 2026 Budget just after Labor Day. Legislative line-by-line review then follows and consumes numerous meetings in the fall. The Legislature adopts the final budget in November.

“This is our first conversation about the budget,” legislator Amanda Champion cautioned colleagues. She appeared to cut the new Administrator some slack. “We have many, many, many months,” Champion said.

Yes, compared with his predecessors—Lisa Holmes, and before that, Jason Molino—Administrator Korsah Akumfi tackles budgeting differently. And his unconventional approach at times left Tompkins County’s 14 legislators begging for answers that seemed elusive. Problems were identified more than directions given. Akumfi’s thick African accent didn’t help, especially in the Rice room, where the acoustics are downright awful.

Then, there were the missteps; too many of them.

“It’s my error.” “I apologize.” “I made a mistake.” Korsah Akumfi uttered those words at various times during his presentation. The administrator had prepared a 60-slide PowerPoint and distributed its paper copy to attendees. Slide number 59, the final one of substance, detailed the tax levy implications, the numbers people care most about. It almost got forgotten. Someone had to restart the computer.

“It doesn’t seem like that second line is correct,” Legislature Chair Klein questioned, after Slide 59 finally appeared. It carried tax increase projections of dollars, percentages, and homeowner impacts.

The presentation’s most glaring error occurred at its worst-possible place: setting the tax levy. Korsah Akumfi is new. County Administration’s budget division is understaffed. And in preparing its numbers, those in charge had committed a major blunder.

As Deputy Administrator Norma Jayne would need to explain later, $1.3 Million in interest earnings had been misstated. The corrected error had transformed a 4.74 percent tax levy increase for the “Maintenance of Effort” budget into a 7.11 percent increase. The slide on the printed page showed the smaller number; the quickly—albeit partially—revised slide on the screen showed the bigger one. (My mumbled astonishment carried to legislators seated in the row ahead of me.)

Norma Jayne, as Deputy Administrator, found herself fixing numbers on the fly as fast as she could. She apologized later. Of course, one bad number in a chain can contaminate everything that comes thereafter.

The preliminary County Budget Administrator Akumfi presented estimates revenues conservatively. Both sales tax and casino revenues were kept flat between this year and next, even though gaming receipts have slightly exceeded recent budgets.

On the expense side, the Administrator predicted only a three percent employee vacancy rate, even though vacancies presently stand at eight per cent of authorized positions. (They’d been 12 per cent one year ago.) Fewer vacancies mean higher payroll. Legislators questioned why Akumfi thinks vacancies will drop by so much. He never provided a convincing answer, at least not that I could discern.

Projections of fund balance—Tompkins County’s comfortably-large year-to-year savings account—left some legislators baffled.

Was that $64 Million General Fund Balance calculated at the start of this year or last, someone asked? Akumfi needed to explain.

“Do we have a plan in this budget to refund our fund balance?” legislator Greg Mezey asked. The Administrator said he did not have such a plan.

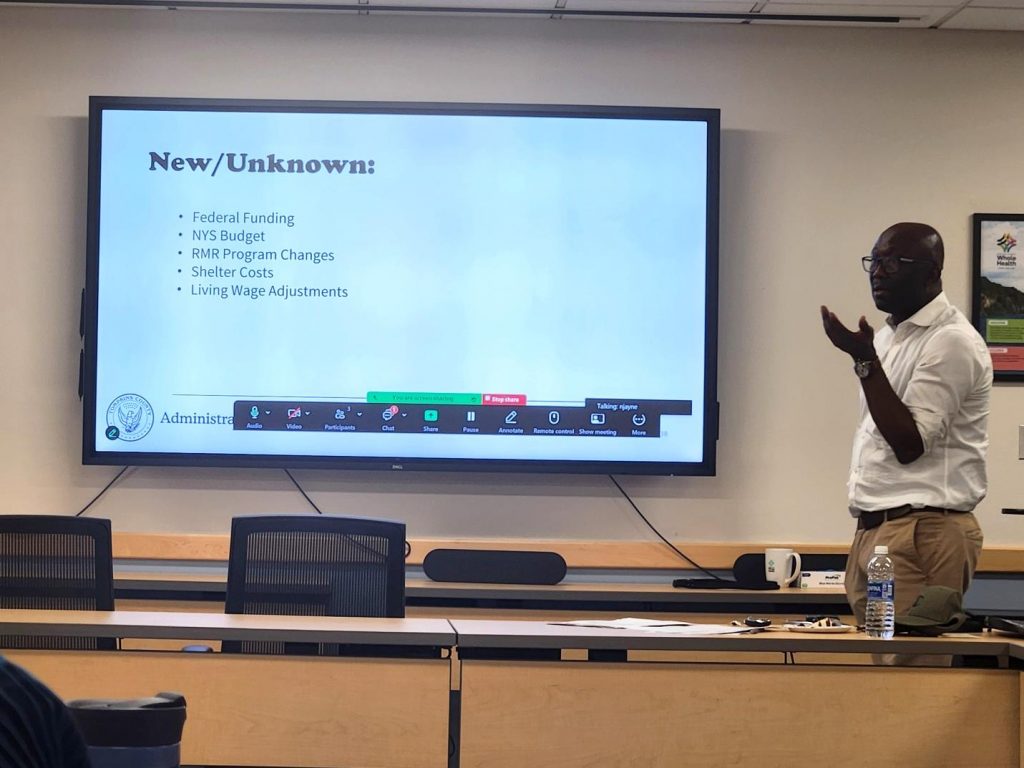

Then, there are what may be called the budget “New and Unknowns,” the wild cards; expenses like the new homeless shelter, the continuation and possible expansion of the Rapid Medical Response (“RMR”) program, and application of the new, higher so-called “Living Wage.”

By past resolution, Tompkins County is a Living Wage Employer. Its government is supposed to pay employees living wages. In late-February, the Tompkins County Workers’ Center grew the calculated Living Wage to $24.82 per hour, up 34.5 percent from its computation of two years ago.

“We had $2.5 Million set aside for Living Wage. Is that off the table?” Dan Klein asked.

Deputy Administrator Jayne said the number was “closer to $1 Million.”

Legislator Shawna Black, a Living Wage advocate, sought to have all 14 legislators weigh-in on the Living Wage’s application, and perhaps do so as soon as that night’s meeting, late as it then was. The discussion didn’t happen. Expect Black to raise the wage issue later.

Emergency Response promoters—including those in Enfield—had hoped the Budget Retreat would provide guidance toward extending, maybe expanding, the RMR program into 2026. That guidance didn’t come.

“Has the funding ended?” Akumfi asked inquisitively when RMR came up. Norma Jayne had to inform him that funding runs through this year. On to the next topic.

****

What’s the message discerned from wading through those laborious 60 PowerPoint slides and listening to what Administrator Akumfi and legislators had to say at the Budget Retreat? Maybe, that it’s still way too early.

Yes, the 2026 Tompkins County tax levy could rise by 7.11 percent—but probably it won’t. More importantly, the evening’s two-and-a-half hours spent in a crowded, window-deprived room told one more about the state of County Government than about the cost of County Government. Some whom we pay handsomely to serve us remain on a learning curve. Others are scurrying around tirelessly to prop their colleagues up. And truth be told, it’ll be darned tough to figure out where Tompkins County taxes will be heading until at least the late summer, if not the fall.

###