by Robert Lynch; August 20, 2025; additional reporting August 21, 2025

Rest assured, Tompkins County, your county tax bill will not rise by the 20 to 40 percent that a worst-case budget scenario, unveiled in late-July, had portended. Something like a four-to-six percent increase now seems more likely. That said, your personal contribution toward keeping our county’s government solvent and humming stands likely to take a bigger bite out of your wallet next January than in years past.

Revised projections, detailed by County Administrator Korsah Akumfi to the Tompkins County Legislature Tuesday night, cut by more than half the roughly $11 Million deficit he’d earlier forecast following a publicly-shrouded Budget Retreat legislators attended July 23. As updated to the Legislature at the August 19 meeting, the Administrator now forecasts a deficit of $4 Million to $4.5 Million.

“How I interpret the process that we adopted is nickeling and diming the departments and agencies and taking $50 from here, $100 there, a thousand from here,” Akumfi described his new style of budget crafting.

“We evaluated the numbers, we as a team… and we have as of now been able to close the gap down to about $4 Million; $4.5 Million,” the Administrator said.

At a July 24 meeting of the Tompkins County Council of Governments (TCCOG), held one day after the Retreat that presumably only legislators and government staff had attended, Akumfi had shared two scenarios. The more restrained of the two, a “Maintenance of Effort” budget would have kept current programs in place, but incurred an $11 Million deficit, one that could only be closed via a 20 percent increase in the property tax levy.

An alternative spending plan, one that would tack on an added $12 Million in spending to underwrite a list of “Enhancement Requests,” would have pushed the 2026 tax levy over that for the current year by a whopping 40.3 percent.

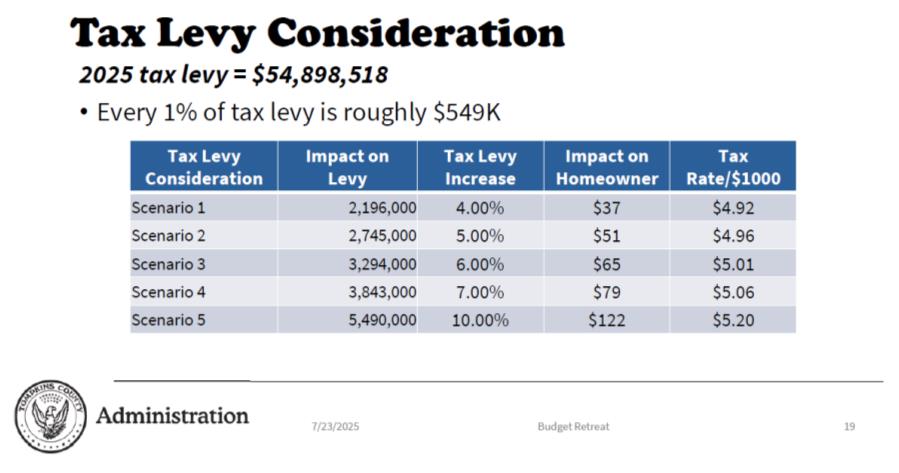

Korsah Akumfi is new to Tompkins County and to its budget process this year. But even he understood that tax increases of the magnitude he’d warned of stand far beyond reason. Instead, at the July Retreat, and also the day later, he’d shared a PowerPoint slide listing alternative levy increases ranging from four to ten percent and predicting the financial impact of each.

“Our goal… is to be able to present a proposed budget that falls within four to six percent,” the Administrator told legislators Tuesday based on his updated fiscal calculations. “We are now hovering around about six-and-a-half percent. So we still have a few days to go.”

Those “few days,” Akumfi predicted, will likely end this Friday. The Administrator plans to reach final recommended figures by August 22, compile budget books for lawmakers to peruse privately next week, and then unveil his recommendations to the public Tuesday, September second, one day after Labor Day.

But at that point, the 2026 Tompkins County Budget will still be far from final. Legislators first will invite department heads and agency representatives to a series of meetings for each to plead his or her individual hardship. Lawmakers will then review budget lines to the point of micro-management. A final budget won’t be put to a public hearing until late-October, followed by the Legislature’s vote in November.

Whatever the finally settled-upon tax levy increase, the percentage is bound to climb above the 2.72 percentage point rise legislators last year adopted for the 2025 County Budget now in place.

“It’s a moving target,” Legislature Chair Dan Klein aptly described Tompkins County’s confusing, labyrinthian budget process, one made even more convoluted by the new Administrator’s newly-preferred math. “This is a process, these are snapshots in the moment, changes almost every day at this point,” Klein cautioned.

It’s next-to-impossible to compare this year’s Tompkins County budget preparation to those of years past. That’s because Korsah Akumfi has insisted his budget flow from the bottom-up and not from the top-down.

Shortly after assuming his employment here in January, Korsah Akumfi made known his distaste for Tompkins County’s two-decade-old practice of setting legislatively-directed “target” tax increases, and then squeezing spending to fit within the target framework. Instead, the new Administrator prefers to first solicit departmental and agency spending requests rather open-endedly, compare them with spending for past years, trim as he deems appropriate, and then hand the Legislature whatever the calculator finally registers.

So it’s of little surprise to the financially astute that a “target-free” budget like this year’s has more headroom for economy—for the fiscal balloon to deflate, so to speak—because those economies were never dictated at the outset.

Nonetheless, department heads and agency leaders never like the prospect of spending less money, and our new Administrator has found that out.

“Speaking to the agencies, we have had several pushbacks,” Akumfi acknowledged to legislators Tuesday, “and we are also pushing back to their pushback to try and present something that is reasonable.”

Something new that Korsah Akumfi has attempted this year, as he informed the Legislature, is a sort of five-year lookback at departmental spending. It appears to be his way of gauging how one department compares to another and whose increases may be out of line.

“So the goal has been to evaluate the departments’ requests as well as agencies as compared to actual expenditures the previous five years and evaluate the reasonableness of the estimate, both revenues and expenditures,” Akumfi said.

Based on that five-year lookback, Akumfi claimed he could trim projected spending below what was first forecast in some categories. The administrator did not identify which departments suffered the curtailments.

Of course, inflation kicks costs up, perhaps more in one department than in another. And fluctuations with state and federal aid can affect departments differently. As such, determining exactly how effective, practical, and successful Akumfi’s new style of budgeting will turn out remains to be seen.

Just a few weeks ago, when the earlier-predicted $11 Million deficit loomed large, Administration blamed the shortfall on a predicted $5 Million increase in spending and a $6 Million loss of revenue. Now, in an effort to partially close the revenue side, Akumfi told legislators Tuesday he’ll recommend $2.7 Million be drawn from what had been set aside last year in a “tax stabilization” reserve. $1.5 Million of that withdrawal would be used to pad down the tax levy; the remaining $1.2 Million would go to unspecified “one-time expenses.”

Akumfi’s Tuesday night “snapshot” defied granularity. It painted with broad strokes. Yet a couple items secured mention, including the Rapid Medical Response service. Akumfi indicated that moneys existed for Rapid Medical Response’s continuation, but only for the service “as is,” not necessarily for any $2.5 Million expansion into a limited county-wide ambulance operation that some emergency response service proponents would like it to become.

Legislators asked Akumfi a few questions, though not many. Deborah Dawson inquired about how the five-year historic lookback procedure would accommodate for inflation and for recent employee collective bargaining agreements. The Administrator retreated to talk of the ongoing “vacancy rate” and its effect on the payroll. He never answered the question directly.

Rich John asked the Administrator to tell him how much of the $6.5 Million in newfound deficit reduction came through lower spending versus enhanced revenue. Akumfi couldn’t parse the numbers.

The Administrator did say there’s not much hope of tapping County Government’s sizable—though shrinking—fund balance, its savings account, for help in closing gaps. County policy currently dictates a full 25 percent of annual expenses remain in fund balance. Although its total lags by as much as a year behind reality, Akumfi calculated the fund balance account now stands well below the policy’s requirement.

Newfield-Enfield’s Randy Brown inquired whether the City of Ithaca, through its sales tax agreements, should be paying Tompkins County a larger share to fund the Department of Emergency Response, especially given the high proportion of 911 calls coming from city residents. Colleague Mike Lane cautioned the issue’s complicated.

Rich John stated he’d prefer Akumfi aim low with his recommended tax levy increase, perhaps keeping it at around four percent, so as to allow legislators in their fall deliberations the flexibility to add-in selected spending items as they identify “where there’s real need.”

“I would much prefer if we came in somewhere closer to the four percent, and this body was looking at additional spending, rather than trying to reduce spending,” John advised. Because when it comes to cutting spending, the legislator admitted, “I don’t think we’re very good at that.”

****

The Legislature’s agenda item that was expected to generate controversy at the August 19 meeting never did. By a vote of 13 to one, lawmakers authorized the temporary relocation of both the Department of Assessment and the Office for the Aging to a newly-purchased one-story office building at 31 Dutch Mill Road, about a mile and a half north of the airport, off Warren Road.

The Office for the Aging would occupy space originally intended for the Board of Elections. At the Legislature’s earlier August fifth meeting, numerous commenters, including a spokesperson for the League of Women Voters, objected to the Elections Office’s move to a rural site, and the Legislature vetoed the idea. Critics contended that a rural office would deprive Ithaca’s urban residents of continued easy access to the Elections Board to sign up to vote or to cast absentee ballots.

In a memo attached to the August 18 agenda, Director of Assessment Jay Franklin heartily endorsed his department’s temporary move. Assessment must relocate to further County plans to deconstruct Assessment’s current home and then build the planned Center of Government on its footprint.

But the Office for the Aging’s relocation to Lansing and out of its downtown home at State and Albany Streets would appear on its face to prompt the same concerns as did the Board of Elections’ earlier-planned move. It would deny convenient access to older adults who may choose to walk to the location or take public transit.

But in contrast to the concerted resistance expressed two weeks earlier by voting rights advocates, no one from the public spoke against the Office for the Aging’s move at the start of Tuesday’s meeting. And Office for the Aging Director Lisa Monroe didn’t address it either. She may not even have attended.

County Administrator Akumfi explained that he had met with Monroe and her staff and quelled any objections.

“So they don’t see this as a disruption,” Akumfi said of Office for the Aging leadership’s attitude. But rather, he said, they view it “as an opportunity so that they can reinvent their programming to serve the residents very well.”

The Administrator concluded that visitors unable to drive to the out-of-the-way Lansing location could take the Gadabout paratransit minibus instead.

Ithaca legislator Shawna Black cast the lone dissent on the relocation plan. She maintained that regardless of its economic and structural attributes, the Lansing location for the Office for the Aging is just too far removed from the community’s center.

“I continue to have very strong beliefs that our forward-facing departments need to be on the bus line and need to be accessible to everyone,” Black asserted. “There are no complaints about the building itself… just the location really does not seem conducive to County business,” she said.

The Office for the Aging relocation arrived to the Legislature last-minute, made known only days before the meeting. Administration had recommended the Office for the Aging’s move so as to later relocate the Board of Elections into Aging’s State Street storefront and thereby satisfy the Legislature’s insistence that the Elections Board remain downtown.

Tuesday’s resolution did not address the Board of Elections relocation.

The Legislature earlier this month purchased the vacant, 13,000-square foot Dutch Mill Road building for $1.2 Million. Assessment and the Office for the Aging would remain there for at least four-to-five years until the Center of Government is finished.

Newfield legislator Randy Brown suggested an even longer relocation. At nine dollars a square foot, Brown asked, Why not stay there?”

###