ICSD proposes levy hike 4x the Tax Cap

by Robert Lynch, March 30, 2024

Jay Franklin, Tompkins County’s Director of Assessment, gave members of the Tompkins County Council of Governments (TCCOG) Thursday, March 28th a tutorial on how his office’s revaluation of properties meshes with local government’s imposition of property taxes. Franklin defended his preferred practice of reassessing properties every year. He argued it prevents valuations from getting stale; assessments either under-valuing or over-valuing properties that have changed in selling price over time.

To that, this Councilperson, Enfield’s representative on TCCOG, raised a counter-argument Franklin acknowledged: Less-frequent reassessments may, in fact, serve a purpose.

“It does make the most logical sense,” I said, endorsing annual reassessment. “The problem is, it ignores human nature, and that is the human nature of the political class.”

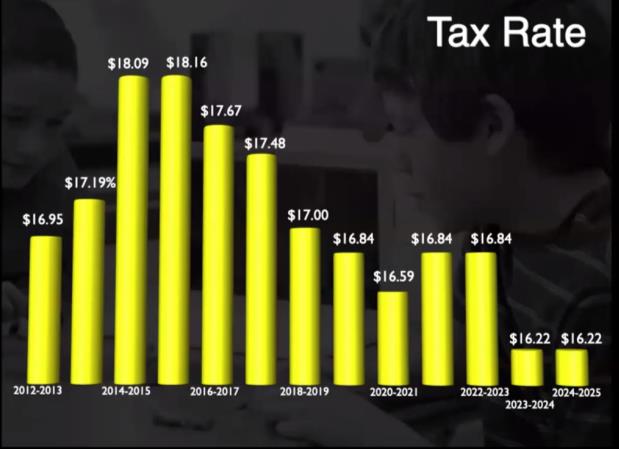

I used the Ithaca City School District (ICSD) as the best example. Its budgeting policy has been on the record and in the news. School Superintendent Dr. Luvelle Brown recently boasted of his budget holding the tax rate steady. And school board member Eldred Harris has cited “cranes in the sky” to credit Dr. Brown’s stunning achievement to all that downtown construction.

“What it fails to take into consideration,” I told Franklin, “is the fact that assessments are going up from individual properties, and so what it allows is it allows a lot of mischief to be made by the political class.”

Call it “mischief” or call it just wise salesmanship. But when Dr. Brown presented his nearly $171 Million next year’s budget proposal to the Board of Education March 26th, he bragged more about tax rates than tax levies. The tax levy represents the true taxpayer cost of educating an Ithaca kid. The tax rate, in its simplest construction, is merely a mathematical derivative.

“This budget that we’re proposing will enable us to stabilize the tax rate and keep it low,” the Superintendent said.

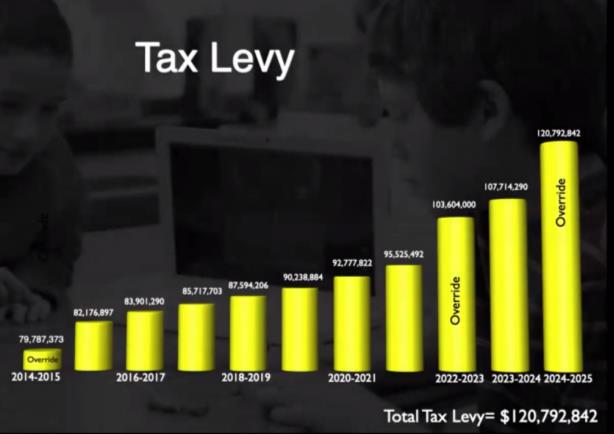

But it’s the tax levy that New York regulators use to determine whether a school district complies with or goes above the state’s now penalty-free “Tax Cap.” ICSD administrators estimate the new tax cap at three per cent. Dr. Brown’s proposed 2024-25 budget would raise the tax levy by 12.14 per cent. Do the math. The levy increase would be more than four times the cap. And nobody at Tuesday’s School Board meeting talked seriously about staying within it.

“Keeping our tax levy at a three per cent increase, then we’re talking about a $9 Million reduction to what we’re proposing this evening,” Brown said. “That’s programs. That’s people. That’s a significant shift, and that’s not keeping up with even our contractual obligations.”

New York State once rewarded a school district’s frugality by providing taxpayers a rebate if a district stayed within the tax cap. Those days are gone. And schools pay no price should their budgets exceed Albany’s magic number. Taxing above the cap only requires that at least 60 per cent of voters approve a school budget in their May referendum.

One may recall that two years ago Newfield’s first-round rejected budget got into that super-majority bind. But Ithaca’s school electorate has consistently proven more obliging. Last year, the Ithaca budget passed with 73 per cent support.

Superintendent Brown and the school district’s Chief Operating Officer, Amanda Verba spent more than an hour last Tuesday outlining the proposed budget to Ithaca School Board members. A few voiced concerns about the increase, yet no one expressed outright opposition. And clearly the Administration put programs first, economies somewhere down the list.

“We are an excellent school district,” Brown insisted. “And we have asked for that, and we are getting it, and we are paying for it in an ongoing way.”

“I remind folks, nobody’s asking us to stop doing anything. They’re asking us to do more.”

“We have seen the most significant compensation increases in the school district’s history over the last decade,” Brown continued. “Now that’s taken a lot of work…. This budget will allow us to meet those contractual obligations… and I’m looking to do even more.”

At an earlier meeting, January 30th, Brown proposed leveraging Ithaca’s ever-growing assessments to provide a 20 per cent pay increase for all employees over the next three years. It was at that meeting when Eldred Harris made his “cranes in the sky” remark.

“So there are contractual agreements that the School District has entered into with bargaining units, and those are guaranteed to the folks,” Amanda Verba cautioned. “They have to receive the increases.”

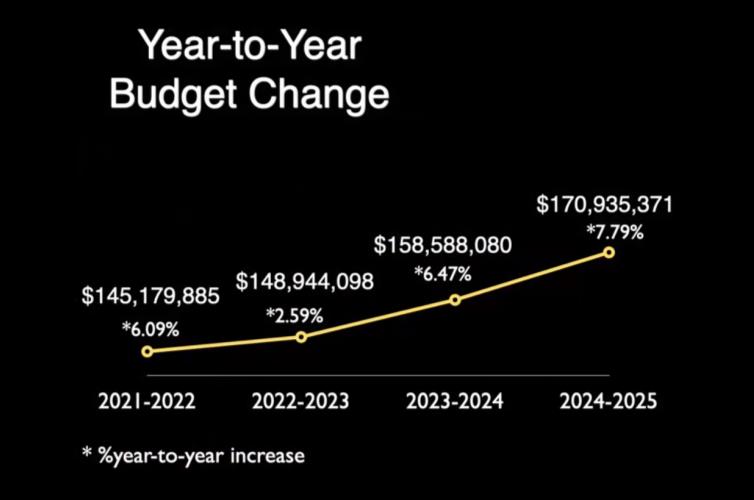

In terms of raw spending, the District Administration’s $170.9 Million budget would rise by 7.79 per cent from this year’s budget of $158.58 Million. It’s a bigger percentage rise than a year ago, and an even bigger increase than the year before that.

Of the $170.9 Million in spending, nearly $120.8 Million would come through the tax levy. While the levy would climb by double-digits, the tax rate would remain same as the current year.

Part of the disproportionate 12.14 per cent rise in the projected levy comes from stagnant state aid, Albany assistance that could actually drop next year depending on ongoing state budget deliberations. Dr. Brown would also rather not draw down the school district’s fund balance, it’s year-to-year savings account. New York rules limit the fund balance set-asides to no more than four per cent of the schools’ budget. Verba said the current balance stands close to that limit right now, though Albany does little more than wag its finger should a district exceed it.

“If the Board determines that this is the year we want to use that (the fund balance) to balance the budget, just know that if we spend it, it will not be there for next year,” Verba warned. “You will have a double-problem then,” Verba said.

School Board member Adam Krantweiss, up for re-election this year, said he’s heard from taxpayers. And he relayed their concerns to colleagues that night.

“They’re wondering and hoping that there might be a way to have that eight per cent (total increase) reduced even if was by a few percent,” Krantweiss said. “And there are some ‘want’ items that could come out of the budget. I think a lot of people would appreciate that relief.”

“Most organization’s budgets are increasing,” Krantweiss acknowledged, “although this does seem like a larger than average increase.”

“I’ve heard those concerns, and I’ve shared those concerns and frustrations each year I’ve been here,” Superintendent Brown acknowledged. Yet he continued, “Our community wants some things. We are at an important time. We’re at an inflection point. I see this budget setting the community up for the next generation of learners.”

“There are some areas where we can make some adjustments,” Brown conceded, suggesting fund balances and future compensation increases as targets for trimming. “I propose something I think is fair, I think is something that will set us up,” he said, “but I’m open to the direction of the Board to what we do to adjust.”

The School Board’s Finance Committee will likely address the budget April 9th. The full Board next meets April 16th. Expect the Board to vote on the budget then.

When Ithaca School District voters go to the polls May 21st, they’ll not only vote on the budget, but also on the purchase of new high-efficiency buses and an ambitious $125 Million capital program, the heftiest capital request in the District’s recent history. Ithaca School District voters seldom reject such spending initiatives. Turnout for its elections is usually anemic. Therefore, the parents, teachers, and staff who do vote hold power to tip the scales in favor of their special interests.

And that “needs before, burdens” approach continued to invade the Superintendent’s remarks throughout his presentation, conveying an impression that a homeowner’s assessment increase is his or her own problem, not the School District’s.

“Our school district is not responsible for tax assessment increases,” Luvelle Brown stated candidly. “And even if we were to plan for what folks got in the mail this week or last week, that may shift. So it’s inappropriate for us to plan a budget based on individual property—even a large swath of property tax assessment increases, period.”

Once again, reliance turned to a stabilized tax rate. Let the impact of your individual tax bill fly where the Assessment Department takes it.

Assuming assessments increase to where Dr. Brown predicts they’ll be, the 2024-25 Ithaca School District tax rate would stabilize at $16.22 per thousand, the same rate as paid in bills last fall. By comparison, this year’s Enfield Town tax rate was less than half that level, or at about $7.20 per thousand. Tompkins County’s tax rate is lower still.

“Over 75 per cent of our budget comes from the tax levy,” Verba advised the school board. And it appears that for reasons not explained at Tuesday’s meeting, the Ithaca School District stands more tax-dependent than most others do.

“For some of our neighboring districts,” Superintendent Brown reported, “it’s almost a direct inverse.” For them, he said, “75 per cent is coming from federal and state dollars, 25 per cent is coming from the local tax levy…. It depends on community by community.”

But why is that? Yes, it might result from New York State funding formulas that often make no sense. But could it also be, as the Superintendent acknowledged that night, that the Ithaca District, and its voters who vote, demand educational excellence beyond what others provide and stand willing to have us all pay for it.

“There’s no new dollars coming from federal or state governments,” Dr. Brown told the Board. Other small-city districts, he cautioned, are reducing programs, increasing class sizes and closing schools. “I’m proposing a budget that won’t have us engage in that conversation,” he said, “because we’re going to absorb the loss of significant federal and state aid.”

But the taxpayer, of course, becomes Dr. Brown’s fiscal sponge. And when the tax bill arrives next October, Ithaca District voters may all-too-readily redirect their anger wrongly to the Assessment Director.

“When I hear discussions about the tax rate, that’s really hiding the tax levy,” Jay Franklin told TCCOG Thursday. “When we say we’re going to freeze tax rate increases, you kind of get into a hidden tax levy increase scenario.”

When adopting its budget, the Enfield Town Board seldom discusses the tax rate, only the levy. Enfield’s rate fell a bit for 2024, yet its Town tax levy rose by seven percent. The levy, not the rate, got the headlines. The Tompkins County Legislature seldom talks about the tax rate, either. The County’s rate tends to tumble like a stone, though the levy this year rose by two per cent. The levy typically becomes the driving force in most places except, most notably, at the Ithaca Schools.

Constant revaluation gives the ICSD a crutch, one it welcomes, and one it leans on. But if, for example, yearly reassessments were moved to a triennial cycle, the crutch could be leaned on only once every three years. And taking it away could bring with it a whole lot more transparency and fiscal discipline.

“We realize there are some unintended consequences that happen sometimes,” Franklin told municipal officials at TCCOG. “It’s hard to know whether it’s the best to change our system, or it’s best to educate school boards and town boards that may not be aware.”

Right now, education must suffice. The Ithaca City School District holds its budget hearing May 14th; its budget vote one week later. Get educated.

###