Raw ’26 numbers portend 20-40% T.C. tax hike

Reporting and Analysis by Robert Lynch; July 29, 2025

Reporters should have been there. They weren’t. They would have had to dig deep to find the date, time, and place. But had a scribe learned of the meeting and then attended, he or she would have gotten a scoop.

Tompkins County has a budgeting problem, a big one; in more ways than one And it’ll likely impact every taxpayer.

Quietly huddling with administrators and key staff Wednesday night, July 23, holding a so-called “Budget Retreat,” members of the Tompkins County Legislature learned the grimmest of fiscal predictions, warnings that didn’t leak out until another meeting the next day. Though summarized five days later in a press release, the budget’s challenges remain misunderstood by many, and the session’s political jousting may forever be kept a secret.

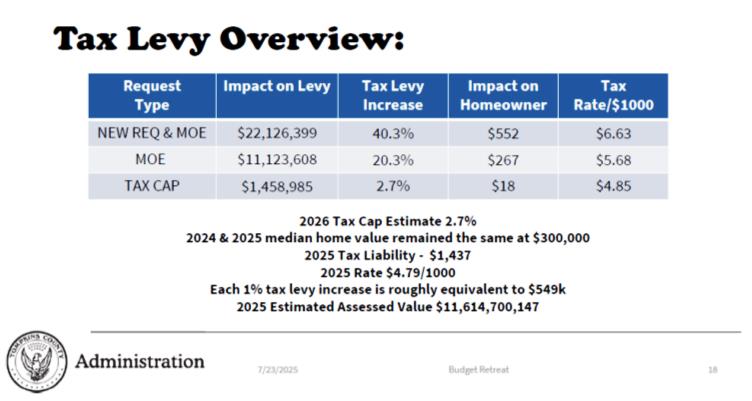

The Retreat’s key take-away is this: If department heads have their way and next year’s spending rises by as much as they’d like, Tompkins County’s 2026 Tax Levy could catapult by a whopping 40.3 percent.

And even if those department heads were to contain their appetites and maintain only the programs that they now have, next year’s levy would still climb by more than 20 percent.

Those kinds of tax increases will never happen, of course. Nobody could stomach them. But still, a property tax increase approaching or reaching the double-digits remains possible.

“Thank you, Korsah; pretty stark;” those the only words a stunned Dryden Town Deputy Supervisor Dan Lamb could fumble forth after County Administrator Korsah Akumfi revealed his revised budget forecast to the Tompkins County Council of Governments (TCCOG) the next day, July 24, a meeting that Lamb chaired. Not only was the Dryden rep first learning of the double-digit danger; so, too, was just about anyone else who chose to listen.

On Monday, July 28, Tompkins County’s Communications Department summarized leadership’s challenge:

“Initial departmental and agency requests… could result in an estimated deficit of over $11 million,” its summary news release stated. Quoting Akumfi, the release blamed the eight-figure claimed deficit on “inflationary pressures, increased demand for critical services, and reduced state and federal funding.”

The release’s facts may be true, but the inferences they invite can mislead. The statement failed to analyze why administrators predict such a mammoth shortfall this time around, departing from projections of years past. Nor did it reference the worst-instance 20-40 per cent tax hikes. They may be too painful to talk about.

So let’s stay with the TCCOG meeting, and not with the sanitized news release, the one every lazy reporter will parrot.

“For us to provide the maintenance-of-effort… and also accept new requests that have come in, we’re looking at the deficit of 22.1 Million. That’s about (a) 40.3 percent… increase on our tax levy,” Administrator Akumfi advised TCCOG of the worst-case alternative.

“And also for maintenance-of-effort alone, if we do not approve any new requests that have come in as of now, we’re looking at a deficit of 11.1 Million,” the Administrator cautioned. “That puts us around about 20.3 percent tax levy increase.” (Akumfi, African-born, sometimes struggles with grammar.)

There’s a good reason an eight-figure deficit is forecast now, and not in recent years past. You can call it the “Akumfi Method,” the recently-hired County Administrator’s new (though perhaps, in truth, retro) way of crafting annual budgets and then presenting them to the elected legislators who hold final authority. Akumfi’s only been on the job for the past seven months. He’s already exerting his influence.

Gone is the long-standing practice of legislators setting a future year’s “target” tax increase in the spring and then asking Administration to match, but not exceed it by September. Typically, legislators hold the target increase at a percentage point or two—or maybe no increase at all. But Akumfi, during last April’s initial budget retreat, persuaded lawmakers to jettison prior habit and set no target whatsoever.

Instead, the Akumfi Method calls on the Administrator to go to department heads, ask them to be frugal, bundle their combined requests, and then leave it to the Legislature to pare them down come the fall. That’s apparently what the Administrator has done.

Yes, instead of taking the role of a demanding, no-nonsense accountant who never smiles, Korsah Akumfi invites departmental budget requests like a jolly, throned Santa at Macy’s. Our 14 legislators must later impose some reasonable discipline as Mom and Dad.

“They’ve dismantled the entire budget process that’s been in place since at least 2005,” one seasoned hand at Tompkins County Government, a person familiar with budgeting, reacted when told of the newly-revealed numbers over the weekend. The retiree recalls that during the early-2000’s, before legislators set targets, initial budget proposals would similarly project double-digit tax increases, only to be followed by tax-paring budget meetings that stretched past Midnight.

So expect the Midnight oil to burn brightly again this fall.

Why the change? Korsah Akumfi, at TCCOG last Thursday, blamed Albany.

“Earlier in the year, we had a budget training session with the state, and the state basically inform us that we usually need to work the budget the other way around,” the Administrator explained. “Look at expense. Look at revenue. Look at where we land; and then based on that, determine which will be a comfortable tax levy to decide on.”

To the best of knowledge, Tompkins County’s target-centered, taxpayer-respectful past practice has never violated any law. And one can safely argue that New York State should be the last place to look for fiscal guidance, given how the Empire State keeps its own house. Better one ask the Town of Enfield’s bookkeeper.

One year ago, Lisa Holmes, Akumfi’s predecessor, was Tompkins County Administrator. At an April 2024 Budget Retreat, Holmes had identified a so-called “Maintenance of Effort” (MOE) budget that kept current programs intact, but added nothing more. Her MOE Budget would have hiked the tax levy by 5.9 percent. Legislators shot it down.

Through a series of non-binding straw polls cast on that April 2024 night, legislators settled on no more than a two percent levy increase. Six of them asked for no tax increase at all. Five would have even rolled back the prior year’s increase.

Over the following summer, Holmes labored to make her legislative marching orders work. She initially requested five percent departmental cutbacks. Her persuasion never succeeded. Following fall fiscal finagling, the Legislature adopted a nearly $265 Million budget in November that raised the tax levy by 2.72 percent.

But that was then; this is now.

A keen observer can detect what’s changed. Korsah Akumfi’s budgeting makes maintenance-of-effort a floor and not a ceiling. True, Lisa Holmes did reference a beyond-MOE budget briefly last year. But the idea went nowhere, and Holmes quickly discarded it. She focused on paring spending down, not building it up. This year, the new Administrator has to date made no attempt to ask that we live with less.

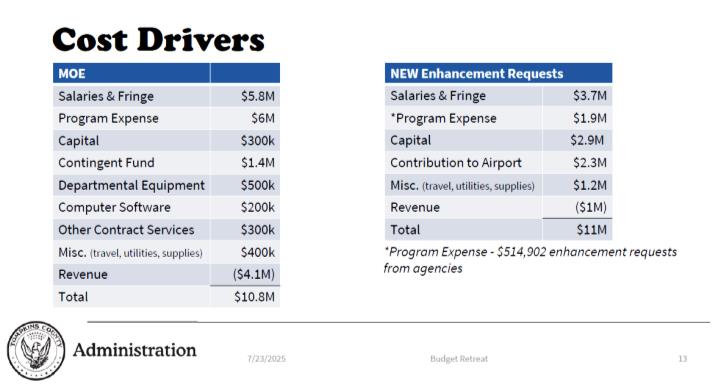

Instead, Akumfi places more than $12 Million in new spending into a category called “Enhancement Requests.” Combined with maintenance of effort, Enhancement Requests would inflate the tax levy by $22.1 Million, raising it from this year’s $57.3 Million to about $79 Million. Just maintaining present programs would add $11.1 million to the levy, the Administration’s budget slides, presented at the retreat, predict.

Though not shared with TCCOG last week, those “Enhancement Requests,” summarized later, though never stated with precision, would spend $2.9 Million more toward capital programs, assign $2.3 Million to the ailing Airport, allocate $1.9 Million toward agency program expenses, and put $3.7 Million into higher salaries and fringe benefits. Those latter increases could reflect granting employees the new, recently-recalculated “living wage,” higher here than just about anyplace else upstate.

In terms of homeowner impact, based on the county-wide median home value of $300,000, keeping current programs intact would raise a 2025 $1,437 tax bill by $267. Adding in those “enhancements” would hike it by $552.

Even the newly-arrived County Administrator acknowledges that a 20-40 percent tax increase reaches beyond reason. One of the 20 PowerPoint slides Akumfi presented the retreat—and later, TCCOG, without explanation—provided five “scenarios” that carry hypothetical, alternative tax levy increases of four, five, six, seven, or ten percent.

“These are scenario numbers that we discussed with the Legislature in terms of tax levy increases that particularly will need to be considered for us to be able to bridge the gap,” Akumfi advised TCCOG’s intermunicipal leaders.

“None of them make up the deficit amount of $11.2 Million,” the Administrator conceded. “So our job in the review process is how do we make changes in terms of increasing revenue projections and also decreasing some of the expenditure projections that have come in. We have the next three weeks to figure that out,” he said.

The Administration’s proposed 2026 Budget could arrive on legislators’ desks as soon as the Tuesday after Labor Day. As things look now, legislators will be left to figure many things out.

What the Fourth Estate’s absence from the Health Department’s Rice Conference Room Budget Retreat cost us was analytical context and political perspective: How did our 14 elected legislators react that night? Korsah Akumfi preferences notwithstanding, were any targets set?

“Was there any direction from the Legislature given at that time?” this writer, Enfield’s TCCOG representative, asked.

“So the legislators did not give us a specific target levy at our meeting yesterday,” Akumfi answered at TCCOG. “But there was a significant discussion around their comfort level and what they will be able to support as part of the proposed budget.”

The Administrator continued, again reaffirming his rebranded budgeting style: “We’re just going to plan the budget based on what the realities are, and hopefully we’ll be able to present a proposed—recommended budget that is reasonable and can be considered.”

This writer pressed the point: “What was the comfort level? Does anybody have an idea of what that was?”

“I would say (of) the number of the legislators in the room, each one mentioned the number they’ll be comfortable with. So there was no consensus on the number. The direction was do your absolute best to recommend the lowest possible levy rate,” the Administrator responded.

Legislature Chair Dan Klein, County Government’s delegate to TCCOG, offered his more telling perspective.

“Some legislators were very nervous and just feel we haven’t got a lot of money in the bank, and others feel like now we need to give it back to the taxpayers,” Klein assessed his reading of the retreat.

And that’s the only assessment we may ever get of a most consequential and newsworthy meeting, one where reporters stayed away, cameras never rolled, and no one took notes.

For those of us on the outside—those of us who pay the taxes—the falling-tree-in-the-forest rule applies. Inside the Rice Conference Room last Wednesday night, fourteen legislative limbs may have tumbled. Yet not one of us heard them crash. The Akumfi Method marches forth.

###